11 Factors in Our Instamart vs Dunzo Review

Quick commerce has reshaped how we grab daily essentials, and two names that come up often are Instamart and Dunzo. We started with a short brief of five factors, but to do justice to both services we expanded the review into eleven focused areas readers care about. This piece pulls together reporting from industry sources (Miracuves, Economic Times, Bundl Technologies, Inc42) and frames things from a practical angle so you can pick the right tool for the right task. Expect clear comparisons of business models, delivery speed, coverage, item selection, pricing, app experience, customer service, workforce practices, and funding.

1. Business model and strategic fit

Instamart is part of Swiggy’s multi-vertical approach, rolled out to complement food delivery with fast grocery fulfilment. That means Instamart benefits from shared logistics, payments, and customer accounts inside an app many people already use. Dunzo started as a hyperlocal courier and evolved to include grocery fulfilment, focusing on on-demand errands and last-mile pickup from local stores. The practical effect is this: Instamart often feels like a natural add-on when you already use Swiggy for food and want groceries in the same place. Dunzo excels when you need a flexible run—dropping off parcels, picking up forgotten items, or ordering from a specific neighbourhood shop.

2. Market positioning and brand reach

Brand matters when you pick services quickly. Instamart carries Swiggy’s brand weight and marketing reach, which helps with awareness and repeat usage. Swiggy users who already trust the platform tend to add Instamart orders without a steep learning curve. Dunzo builds a different identity: a nimble local helper that can fetch anything from a kirana to a bakery or courier an important document across town. That positioning has earned Dunzo loyal users who value versatility over a single-vendor catalogue.

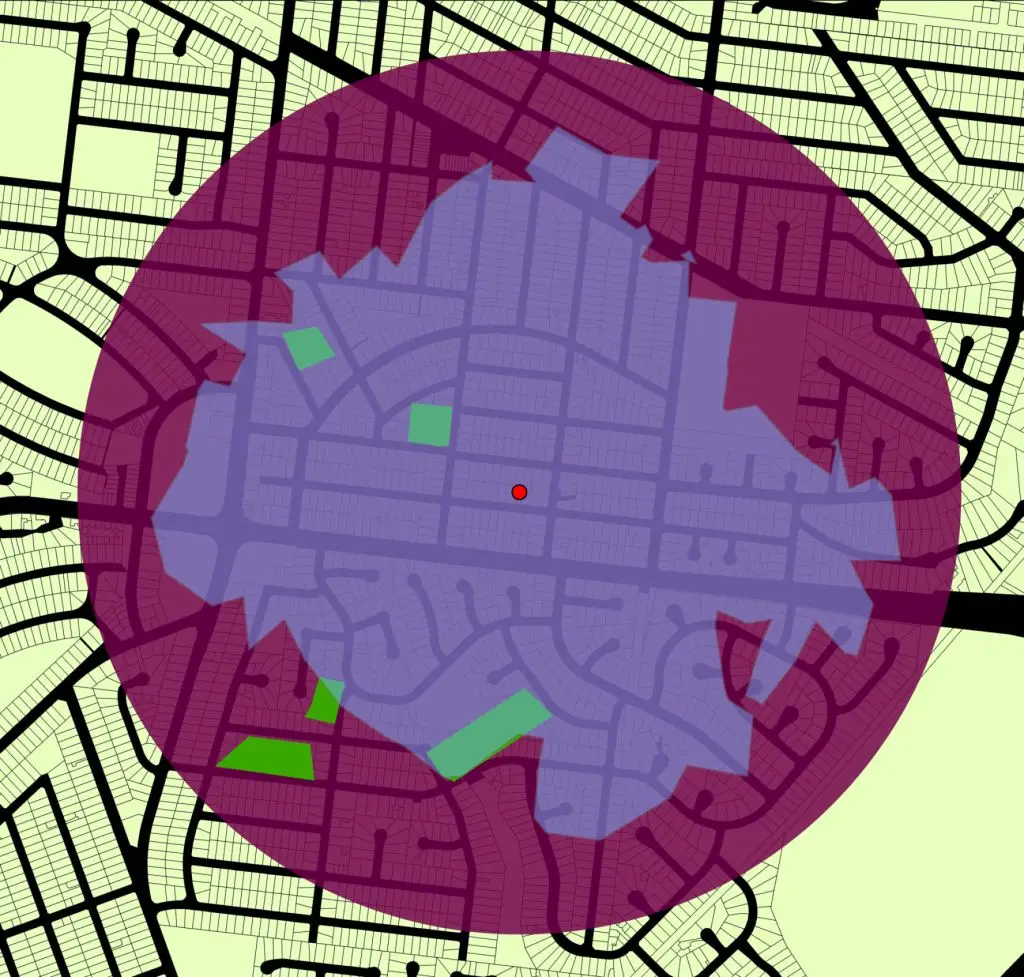

3. Geographic coverage and city density

Coverage determines how fast and reliably a quick-commerce platform works in your neighbourhood. Instamart runs in 40+ cities and is backed by Swiggy’s larger presence in 300+ cities (Bundl Technologies, 2025), meaning it often has better odds of availability in metropolitan and tier-1 markets. Dunzo’s footprint varies by city; it historically focused on dense micro-markets and built deep local ties in those pockets. The result is a trade-off between breadth and neighbourhood density.

4. Delivery speed: advertised times vs real-world expectations

Speed is the promise of quick commerce, but advertised times don’t always tell the whole story. Instamart promotes 10–30 minute delivery windows in areas with well-placed dark stores, backed by Swiggy’s considerable delivery fleet (Miracuves, 2025). Those times can be realistic for short distances and commonly bought items. Dunzo, with its roots as an errand-runner, often competes well for single urgent items because it dispatches riders for bespoke pickups from local stores.

5. Delivery performance during peak and off-peak hours

Delivery performance changes with demand. During evening peaks and weekend surges, rider supply and dark-store throughput determine whether promises hold. Instamart benefits from Swiggy’s larger rider pool and route optimisation during busy windows, which can smooth deliveries at scale. Dunzo’s model, which depends on flexible on-demand riders and merchant partners, can be either nimble or inconsistent depending on rider availability in a given neighbourhood.

6. Product selection and SKU strategy

Quick commerce isn’t about stocking everything. Platforms curate SKUs to focus on high-turnover essentials. Typical quick-commerce dark stores hold about 5,000–6,000 SKUs, compared with traditional supermarket catalogs running many times that number (Bundl Technologies, 2025). Instamart’s selection tilts toward daily staples, branded essentials, and impulse buys that move fast. Dunzo often connects customers to local stores and a mix of partner inventories, which can include regional or speciality items not present in a standard dark store.

7. Pricing, fees, and promotions

Pricing depends on base price, delivery fees, surge charges, and promotions. Instamart benefits from Swiggy’s ability to run cross-category promotions and bundled discounts that reduce the net cost for users who already order food on the platform. Dunzo often promotes single-run discounts, first-order offers, and neighborhood-specific deals with local merchants. Delivery fees can vary by city, time of day, and rider availability, so a direct price comparison needs context.

8. App experience and ordering flow

App UX shapes how fast you place repeat orders. Instamart lives inside the Swiggy app, making cross-category discovery and reordering very simple for existing users. Your food and grocery orders share the same wallet and address book, so recurring lists are convenient. Dunzo’s app centers on quick task creation, letting you describe an errand or choose a local store for a pickup with fewer taps for non-standard requests.

9. Customer support, refunds, and reliability

Customer service shapes how problems get fixed. Swiggy’s larger support machinery standardises processes for refunds and order issues on Instamart, which helps with consistent policy enforcement. Dunzo’s local merchant relationships can produce fast, tailored fixes in some cities but inconsistent experiences in others because local partners differ in systems and scale. Public reviews and forum discussions show both apps get praise and complaints; the difference is often how each resolves issues in a user’s city.

10. Courier workforce, sustainability, and local partnerships

Workforce practices and local partnerships affect reliability and social impact. Instamart leverages Swiggy’s rider base and invested dark-store footprint, which helps with consistent routing and scale-managed rider schedules. Dunzo’s model historically engaged local couriers and shop owners, creating more direct support for small merchants in some markets. Sustainability efforts—such as bike deliveries or reusable packaging pilots—appear across players and are worth watching as indicators of long-term operating costs and carbon footprint.

11. Investment, financial backing, and long-term runway

Financial backing affects product investment and long-term service continuity. Instamart benefits from Swiggy’s broader funding access and strategic prioritisation; industry reporting notes Instamart’s significant share of Swiggy GMV (25%+ cited in Miracuves, 2025). Dunzo secured early strategic investment, including support from major backers like Google in its earlier stages (ArtHnova); that backing helped it scale and pivot into different city-level services. The quick-commerce sector has continued to attract investor interest, though valuations and burn rates vary across companies.

Which one should you pick?

Choosing between Instamart and Dunzo comes down to what you need most and what your neighbourhood supports. Instamart is a sensible pick if you already use Swiggy, want the convenience of one app for food and groceries, and value predictable, fast delivery from curated dark-store inventories. It benefits from Swiggy’s logistics and promotional engine, and public reporting shows it is an important revenue contributor to the parent company (Miracuves, 2025). Dunzo stands out when your needs are less about a curated grocery basket and more about flexible local runs—fetching odd items, delivering parcels, or sourcing from a particular neighbourhood store. Its errand-first roots make it a versatile helper for one-off tasks.